Testing Investment Funds with a Monte Carlo Simulation

Fund managers pride themselves on their ability to beat markets. When we see a managed fund out performing the market, the manager would like us to think it’s their skill, but how can we test that it’s not luck?

We can look at the markets they trade against and compare them to some random funds. If the random funds have similar performance to the managed fund, then there’s nothing special going on with the fund. If the fund outperforms our random trades, perhaps they’re on to something.

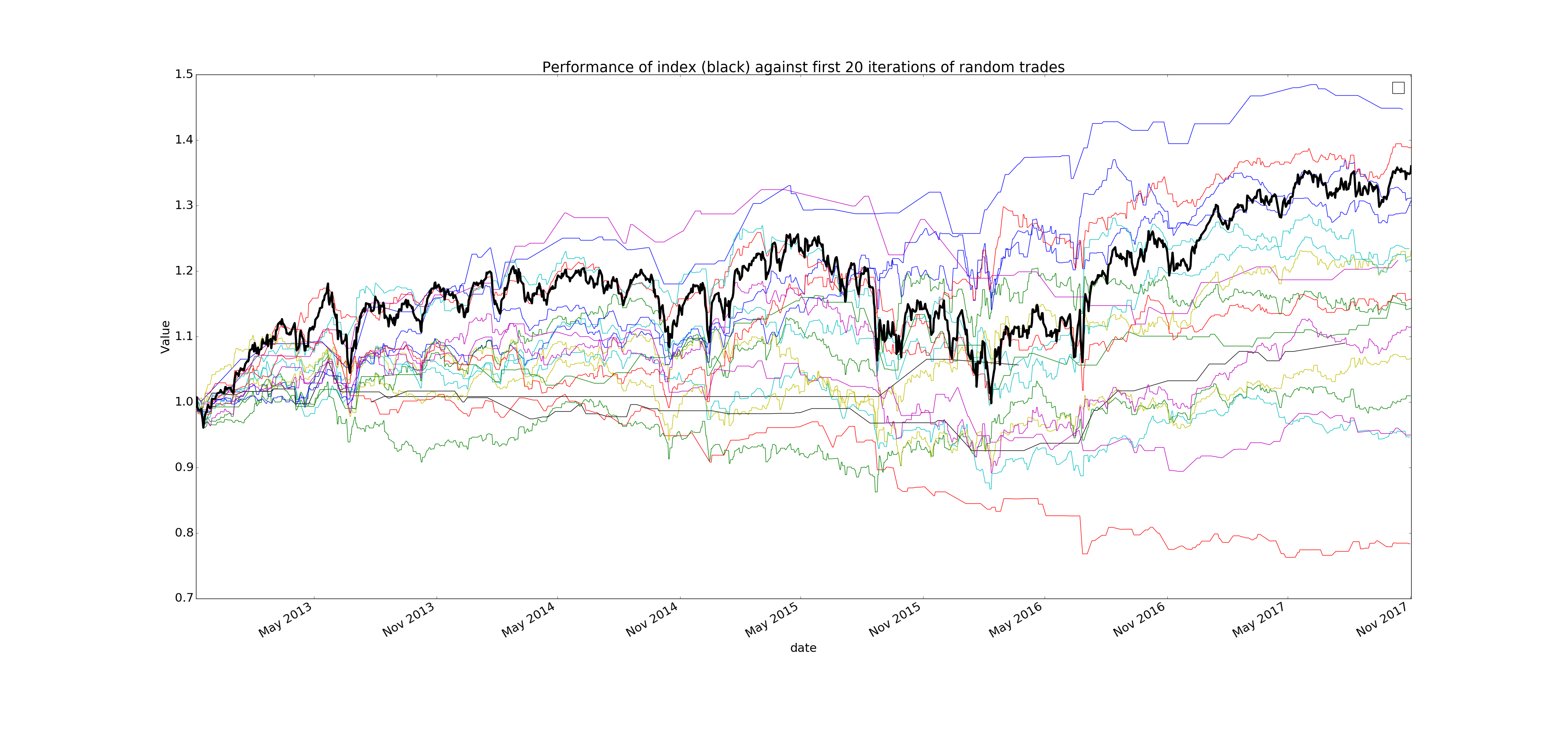

I’ve taken FTSE all shares index data from google finance and simulated a series of random trades against it. I repeated this 5000 times to see how well random trading performs against the index. In the graph we see the performance of the FTSE all shares (black line) and the performance of a few of the random strategies trading on the FTSE all shares.

With the random strategy, everything is either on or off the market, trading is free, our funds only follow index movement whilst on the market (no dividends) and see no change when off the market (no interest).

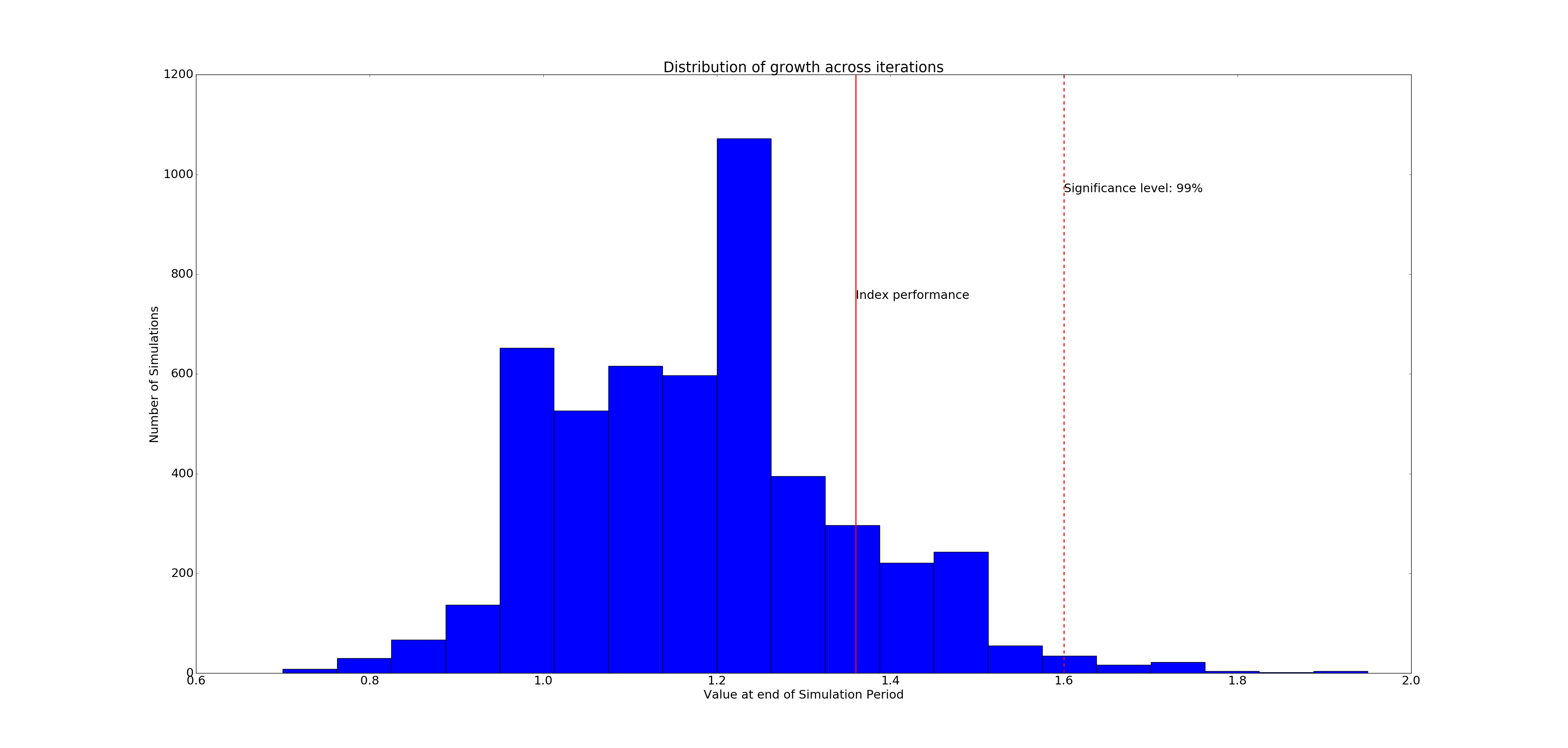

Plotting all the final values of our random strategies on a histogram gives us some numbers to compare against. After 5 years the index achieves 36% growth (excl. dividends), most of our random strategies see about 20% growth and fewer than 1% achieve growth over 60%.

The random strategies generally under perform against the index because the index is trending up. Any time the money is off the market it misses out on the general upwards trend. I’d expect random trades would beat a downward market.

We can compare all the random trades with AXA Framlington UK Select Oportunities managed by Nigel Thomas. He invests in UK businesses, but how does he compare to random trading against the index?

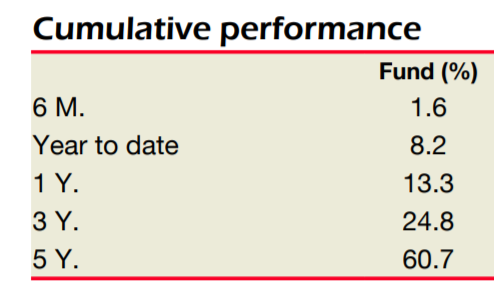

To the end of November 2017, his performance was:

Consider that the fund objective is:

To achieve capital growth by investing in companies, primarily of UK origin, where the Manager believes above average returns can be realised.

He delivered about 60% growth over the 5 year period which is about as good as the top 1% of random strategies and the random strategies don’t get dividends… I would say his returns are quite average.

Thanks for reading.